CORPORATE Internal liability

Part 1 - Internal liability

Breach of the general duty of care as managing director

Well over 70’% of liability proceedings involve claims that constitute so-called internal liability claims. In these cases, the company is the creditor and takes action against its managing director or former director. Third parties or shareholders are not entitled to sue in these cases.

The core allegation in these cases is always the breach of duties of care. The accusations are usually based on the general liability standard of § 43 Para. 2, Para. 1 GmbHG (German Limited Liability Corporation Act).

According to § 43 Para. 1 GmbHG, the managing director must exercise the diligence of a prudent business person in the company’s affairs.

According to the principles developed by case law, the managing director owes the care that a prudent business person in a responsible management position must observe when independently representing the financial interests of third parties. As the custodian of the financial interests of third parties, he or she must pursue the company’s purpose and, thus, the company’s corporate purpose as effectively as possible and generate profits in compliance with all legal and statutory provisions. Subjective knowledge, skills, and abilities are irrelevant. The experienced and well-trained managing director is liable according to the same principles and extent as the inexperienced or inexperienced manager.

The managing director, therefore, owes the company’s commercial conduct, proper organization, strategic delegation, compliance, monitoring, documentation and accounting, compliance with the law, and confidentiality.

However, economic success or failure are only suitable criteria to a limited extent. The managing director must continuously pursue the best goal and economic success for the company and thereby becomes liable if he makes his decisions in business dealings without an appropriate data basis and appropriate risk assessment, thereby causing financial damage to the company.

Following the example of the US doctrine on the “Business Judgement Rule,” he is entitled to vast entrepreneurial discretion when it comes to assessing future economic developments in the market, competitive behavior, changes in exchange rates, the assessment of business opportunities, and business risks, and making a corresponding decision based on this.

According to the case law of the German Federal Court of Justice (the fundamental ruling of the Federal Court of Justice of April 21, 1997, WM 1997, 970ff, known as the “ARAG” decision), entrepreneurial action by the managing director does not lead to liability if it is based on a sense of responsibility, is oriented exclusively towards the company’s welfare and is based on a careful determination of the basis for decision-making. The willingness to enter into risks must not be taken to an irresponsible extent.

Therefore, liability for entrepreneurial action can generally be assumed if you do not assess impending risks or consider the risk environment of the entrepreneurial decision.

A disadvantage for managing directors in legal disputes is that the managing director must prove that he acted according to his duties. Contrary to the usual requirements of civil law disputes, the company, as the claimant, must not prove the breach of duty. Still, the managing director must be able to demonstrate that he acted under his duties.

Based on the trustee and fiduciary model in the interests of third parties, the managing director shall document the basis and methods of his decision reasonably to be able to hold them up to the company in the event of a dispute.

Unfortunately, disputes often arise in situations in which either an insolvency administrator, as an appointed and expert third party in the supposed interests of creditors, suddenly seeks to blame the economic decline of the company on the managing directors who were previously responsible for adding assets to the distributable assets and cover his fees, or when changes have taken place in the shareholder structure. It is often the new investors (e.g., venture capital funds or private investors) who want to shift the loss of their investment onto the shoulders of the management. However, personal changes or other economic innovations can also create conditions in long-established suitable shareholder structures that provoke disputes at the shareholder level, which ultimately leads to accusations against the management.

In addition to incorrect business decisions, organizational and delegation deficiencies can lead to the managing director being liable to the company for the resulting damages.

For example, the calculations for orders, the associated contract conclusion, and the corresponding post-calculation must be recorded and documented comprehensibly to third parties. If, for example, it is no longer possible for third parties to subsequently understand what performance the company owes to customers, it is also impossible to determine whether any special services were provided that would also be billable and, therefore, relevant for the company. It is not a question of whether the managing director acts with entrepreneurial success for the company but whether he has achieved the best possible entrepreneurial success under the given circumstances. In doing so, he must design his corporate structure and organization so that the employees can fulfill the tasks in the best possible way and comply with the law.

Liability is unlimited in terms of amount. However, the claim expires five years after the company realizes the damage incurred. In liability proceedings, the company must prove the damage and explain the circumstances from which the causality of a possible breach of duty for the damage incurred arises. The managing director must prove that he acted under his duties.

In cases of crisis and related restructuring situations, the managing director’s liability arises analogously to Section 43 GmbHG from Section 43 StaRUG – German Company Stabilization and Restructuring Act.

Exceptional cases of internal liability

Payments to shareholders

The privileged liability of the company for the share capital in favor of the shareholders vis-à-vis third parties is an advantage of the GmbH. This liability privilege is one side of the coin, the other side of which is the special provisions of GmbH law for maintaining the share capital. The share capital is the liability guaranteed to third parties by law. Although this may be lost in general business transactions, it may not be withdrawn from the company in favor of the shareholders who invoke the liability privilege.

By §43 Para. 3 GmbHG, in conjunction with §30 GmbHG, the managing directors are therefore liable if they initiate payments to the shareholders when payments are charged to the share capital. This consequence means that managing directors must pay particular attention when paying shareholders. They must always keep an eye on the company’s economic situation in this regard. This legal consequence applies even if the shareholders instruct the managing director to make such a payment. The instruction does not always result in an elimination of the managing director’s liability.

These considerations are also relevant in cash pooling structures or the case of other loans granted to shareholders. They also apply in cases where loans are granted within corporate groups. The loan to a sister company is ultimately financing that benefits the shareholder, in which the recoverability of the loan repayment claims must be monitored. In case of doubt, the managing director must demand repayment of the loans against the interests of the shareholders to avoid personal liability. The managing director’s professional employment may be at stake in such constellations.

Payments to shareholders in the event of insolvency

Times of crisis in a company are tough and liability-laden times for the management. On the one hand, attempts must somehow be made to avert economic failure, while on the other hand, the legal responsibilities burden those involved.

Under Section 15b InsO, managing directors are liable to the company for ensuring that they do not make any payments to third parties outside the ordinary course of business of the company once insolvency maturity (inability to pay or over-indebtedness) has been reached. In particular, the occurrence of over-indebtedness is only sometimes recognizable. This effect requires the managing directors to determine the liquidity status of the company at short intervals in such times, to keep an up-to-date liquidity plan and, in addition to making the necessary determinations to check whether there is over-indebtedness, to carry out the corresponding work to determine whether the company can still be given an optimistic going concern forecast.

Under Section 15b (5) InsO, managing directors are liable for payments to shareholders insofar as these payments lead to the company’s insolvency. Even if there is still much movement in case law and literature on this liability standard, the management shall check and document any funds transferred to the shareholders at such times. Above all, the impression must be avoided that the shareholders wanted to secure company funds. Not only will these payments be contested and reclaimed by an insolvency administrator, but the managing director will also be liable for this with his private assets.

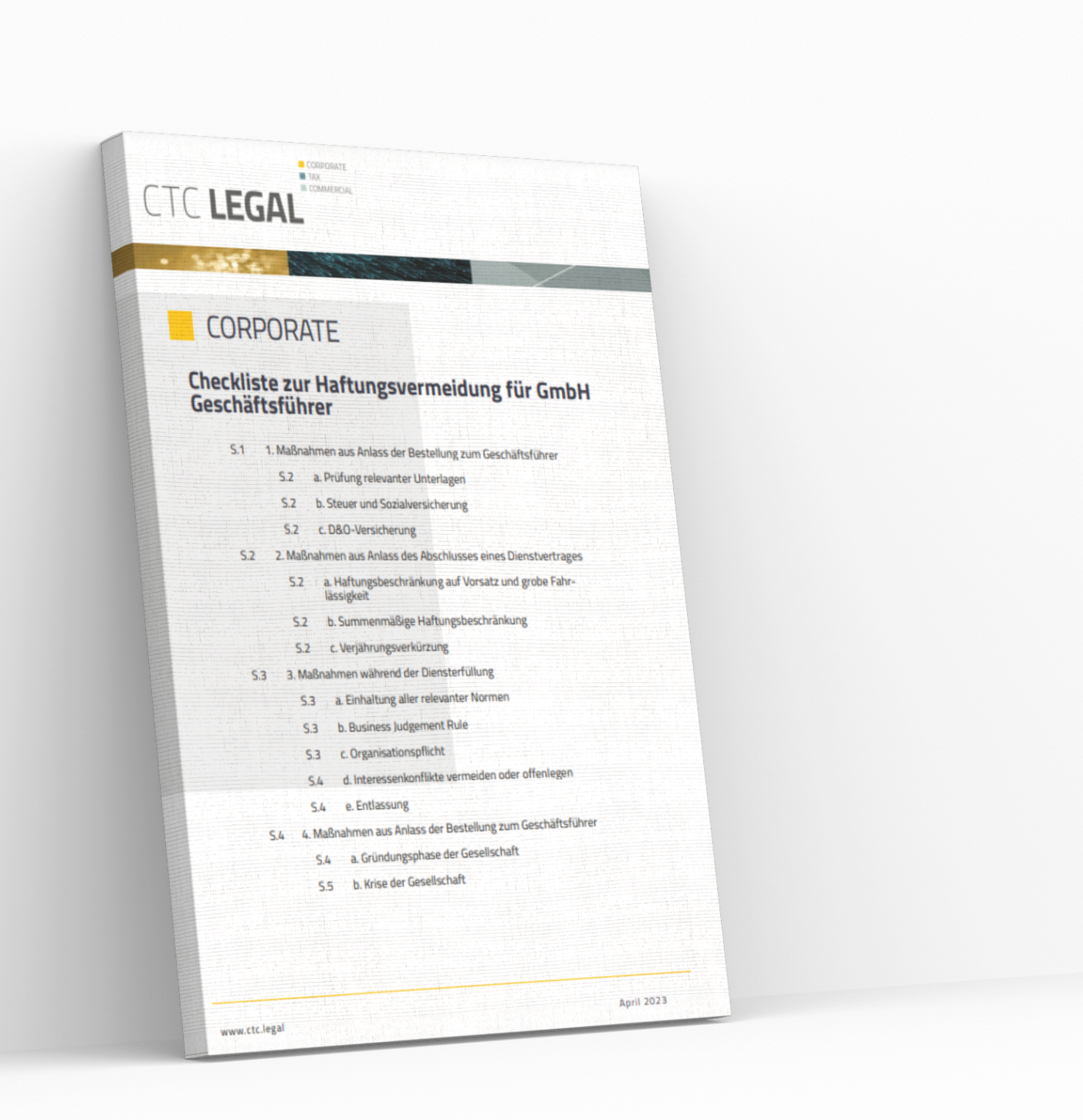

Checklist on managing director liability for GmbH managing directors

Our checklist contains measures for various business situations to limit liability risk. Enter your email address in the form and I will send you the measures free of charge.